There is no better time to upgrade your heating and cooling system.

The Inflation Reduction Act of 2022 (IRA) provides major tax credits for installing high-efficiency HVAC equipment. Up to $2000 for one heat pump, or $3200 for two heat pumps.

Even better, we’re also offering Instant Rebates up to $1200 on qualifying equipment, which can be stacked with the tax credits for incredible savings on HVAC systems for your home!

What’s a Heat Pump?

A heat pump is an electric system that effectively cools and warms your home. It’s a more energy-efficient alternative to a furnace and AC compressor.

In warmer months, a heat pump pulls heat from inside your home and moves it outside. In the colder months, it does the opposite, collecting heat from

the outdoor air and moving it indoors. Modern heat pumps perform well in virtually all temperatures, from extreme heat to below freezing.

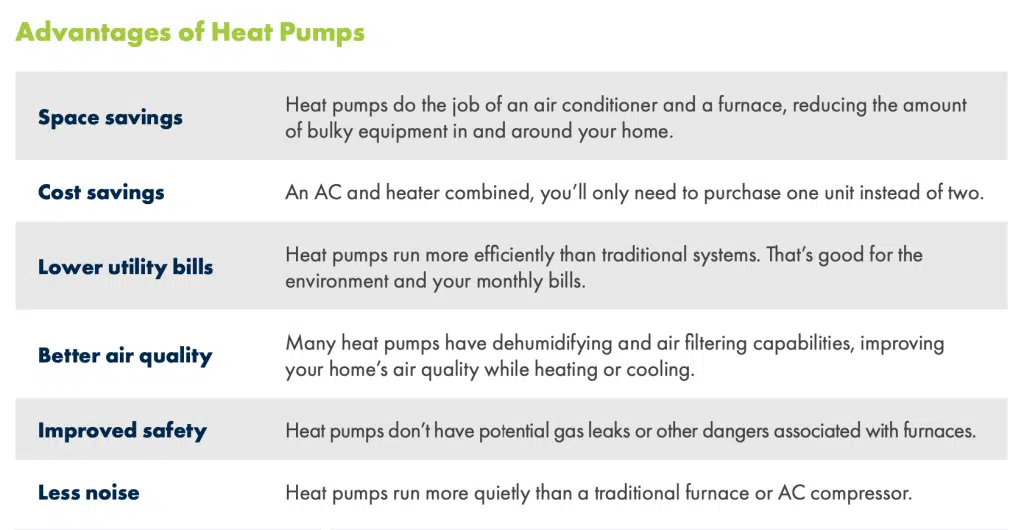

Why Upgrade to a Heat Pump?

A heat pump can improve your indoor comfort, and upgrading from an older HVAC system can lead to significant energy bill savings for years to come.

Get an Estimate & Watch the Savings Add Up

Contact us today or book online for a free estimate on energy efficient HVAC systems for your home. Or call (770) 271-7511 soon before these offers expire!

*Subject to credit approval, see store for details. This information should not be considered tax advice. All information is for educational purposes only. Contact your tax professional for specific, applicable details.